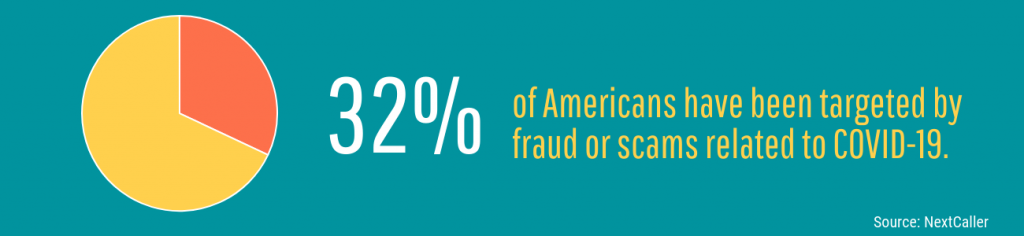

COVID-19 has turned our world on its head: businesses have been forced to close their doors, the stock market continues to fluctuate, and unemployment claims are soaring. Business owners and managers are dealing with revenue uncertainty, painful layoffs, and plenty of other stressors. Now, they must add coronavirus scams to the list. As the majority of the population struggles to deal with this new normal, opportunists have taken notice—and unfortunately, taken action. With the rise of coronavirus cases across the country, there’s also been a marked increase in related scams. New research found that about 32 percent of Americans surveyed believe they’ve already been targeted by fraud or scams related to COVID-19.

To protect your business and team, keep a watchful eye out for scammers, and make sure your employees can recognize important warning signs.

- Stimulus Check Scams

- PPE Scams

- Robocall Scams

- Charity Scams

- Email Phishing Scams

- Ill Employees

1. Stimulus Check Scams

The government is now dispersing stimulus payments to American taxpayers, and there are also financial relief packages available to business owners. There’s plenty of confusion regarding how and when business owners might receive the financial help promised, and scammers are capitalizing on this uncertainty. Fraudsters may call pretending to be from the government or your bank, then ask you to verify your bank account in order to deposit your funds.

Don’t fall for it. The government will never contact you by phone or email to ask you to verify this information. If you think you’ve been a victim of tax fraud activity, be sure to report it to the IRS.

2. PPE Scams

Businesses that have been deemed essential are allowed to keep their doors open, but with that comes increased risk. Employers are scrambling to find personal protective equipment (PPE) supplies to outfit their team with masks, gloves, and hand sanitizer. Scammers are taking advantage of this desperation, claiming to be selling in-demand supplies including test kits, coronavirus-formulated household cleaners, and surgical masks. If you receive texts, social media ads, or robocalls offering these products, don’t purchase.

Be wary of websites that mimic the general look of well-known online retailers. These sites may claim to have the essentials you need at great prices; in reality, these are fake sites. Once you enter your credit card information, the scammers will cut and run. Only buy products from websites you trust, and do a bit of online research before placing an order. Speak with contacts in your industry to verify that a given supplier can be trusted; if no one in your professional circle has heard of the site, think twice.

3. Robocall Scams

Several new types of robocall scams have surfaced in the wake of coronavirus. The FTC recently published three audio recordings that highlight the ways scammers are targeting both business owners and employees:

- Scammers are contacting small businesses and alleging that the respective business’s Google listing won’t be seen by customers during the pandemic

- Individuals have been told their Social Security will be suspended within 24 hours due to fraud

- Individuals have been offered a “coronavirus hotline” to receive a free at-home test

While these scams are likely to shift throughout the duration of the pandemic, it’s important that you and your team remain up-to-date on the latest frauds. AARP offers a scam tracking map that can help business owners and individuals spot fraud across the country; send this tool out as a resource to your team members.

4. Fake Charities

Every bad situation has a silver lining, and these hard times are giving many of us the chance to do more for our communities. Unfortunately, scammers may try to capitalize on your goodwill. If your business is planning to donate money to charities helping those affected by the COVID-19 outbreak, make sure the organization is legitimate. Scammers will reach out asking for donations to their “charitable organization.” If you’re looking for ways to help out your community, check out CharityNavigator.org to ensure the organization is legitimate.

5. Email Phishing Scams

Phishing scams have long plagued business owners, but the current economic climate may make it harder for your team to spot this type of fraud. In the past month, businesses have been inundated with unique financial situations and transactions: refunds, expedited order requests, cancelled contracts, and more.

Now, emergency requests from a client or supervisor may not strike your team as strange; plus, with teams working remotely for the foreseeable future, employees may be less likely to check in with superiors to determine if the request is valid.

Warn your team about the prevalence of these types of scams, and make one person a point of contact—all requests for money or financial information should receive their authorization first.

You should also provide your team with these tips for recognizing phishing emails:

- Always analyze the email address: If the email appears to come from someone in your organization, double-check the sender’s email address

- Watch for generic greetings: If a colleague sends “Dear Madam or Sir”, it’s likely a scam

- Requests for personal information are a red flag: Any email that asks for personal or bank information is likely a phishing scam. Legitimate government agencies or organizations won’t request that information over email

- Keep an eye out for grammatical mistakes or spelling errors: If there are noticeable writing issues within a request for money or information, chances are it’s a phishing email

6. Ill Employees

If you receive a call from an unknown number, and the person claims to be an employee requesting financial assistance, take caution. Thieves will impersonate coworkers, employees, family members, and friends, then claim that they’re in the hospital with coronavirus and need money to cover treatments.

Before handing over any money, reach out to other friends and family members to see if they’ve heard anything similar. You may also consider asking the person on the phone a personal question that only they would know the answer to. If they fumble or provide an incorrect answer, it’s likely a scam.

Key Takeaways

As we navigate this new landscape, be vigilant with security and keep an eye out for the above scams. Encourage communication with your team to ensure you can collectively spot and stop these schemes before they damage your business.

Comments are closed.